Banks make final approval, official form, with schedule for documentation, lays out detailed requirements

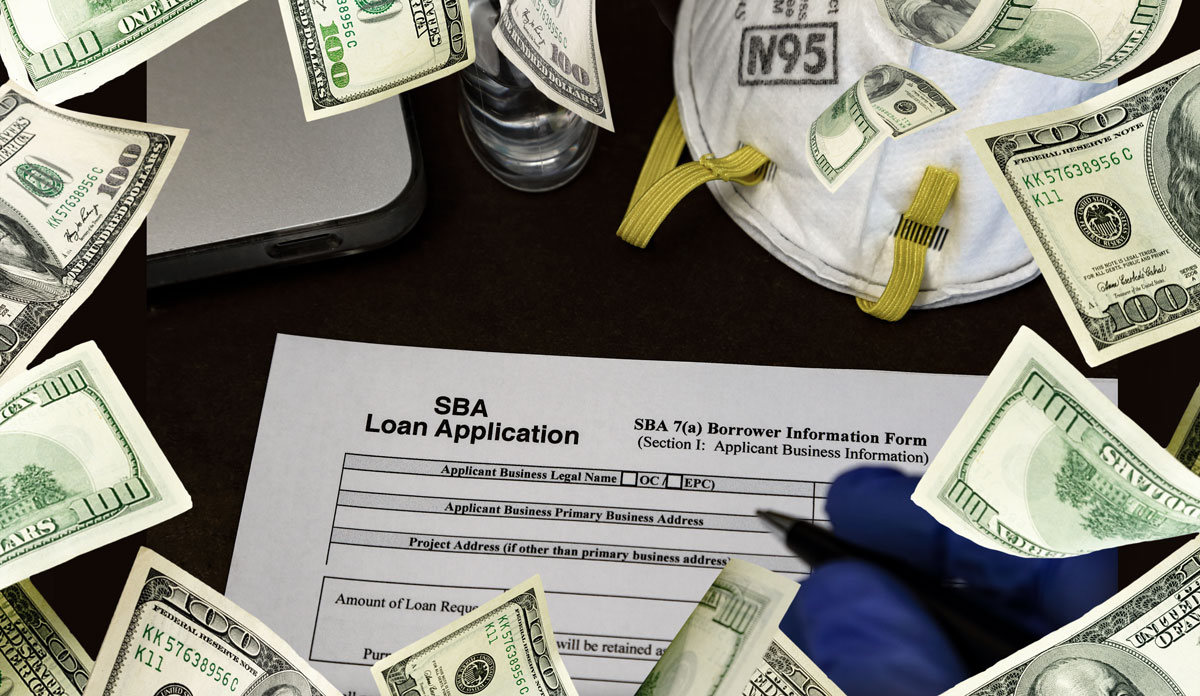

The US treasury department, along with the SBA made the highly anticipated document and details available on Friday. The application, which can be downloaded from this link and printed, or filled out online, contains the requirements needed in order for the so called Paycheck Protection Program, or PPP, recipients to apply for forgiveness under the program.

Read more: Lynxotic coronavirus coverage

This release also clarifies the process whereby the borrower must fill out the form and provide any additional accompanying documentation. Once completed the borrower must submit the form and accompanying documents to the lending institution where they received the PPP funds. The lending bank will make the final decision to approve any forgiveness.

The 11 pages included in the file consist of the forgiveness application itself and instructions on how to fill it out. The application itself has two important schedules: Schedule A and the worksheet for Schedule A.

Key is the 60-day period which has been designated as the period within which the funds must be used, in order for the expenses to be forgivable. In some cases there can be, apparently, some flexibility regarding the date an expense was incurred, such as hours worked by employees, vs. the date those incurred expenses were paid, such as the scheduled payroll payment date or pay period closing date. The applicable dates, can in some cases, be the date the expenses were incurred, not paid, in case of discrepancies.

Read more: Read “Deadliest Enemy” for Deep Background on Pandemics and the Danger of a Second Wave

While some may find this application and the accompanying instructions more than sufficient, such as ongoing businesses that maintained employment and lease / mortgage payments, and already have a ratio to costs between them at 75% / 25% as prescribed in the original guidelines. Others, however, may have a more difficult time deciphering what exactly they can or can’t expect forgiveness for.

Though the release is a major step toward clarification, confusion still abounds in the details of the program and forgiveness eligibility

Articles are appearing online picking apart the confusion that may be caused by this initial attempt to clarify the process and set it into motion. The SBA has indicated that more guidance will be forthcoming.

One gripe being mentioned is the lack of narrative-based guidance, basically a verbal explanation for the various cases that could potentially arise and how they should be handled.

Many businesses had to furlough or fire employees due to lack of funds and then re-hire or re-activate them to comply with the SBA program, in particular wanting to be sure to qualify for forgiveness. This was an acute need in some situations, such as restaurants or other businesses that were required to close and deemed non-essential. In many of those cases the employees were paid not to work or to do minimal work while receiving a full paycheck.

Read more: “Wuhan Diary” reveals inside accounts of Coronavirus Lockdown During the Peak

Companies in that situation, even with full forgiveness granted, face a daunting, uphill battle to regain profitability or viable revenue streams to keep them running after the 60 days of funds has run out. The lingering effects of the pandemic and the lock-down and stay-at-home orders along with the general state of fear (well founded in many cases, it appears) create a situation where former levels of business revenue and activity may take a long time to regain.

This is not taking into account the economic after-effects and general depressed state of consumption being seen in current national published data.

While the SBA has taken a large and positive step forward with the release of this application and achieved some clarification of the process, much more help for struggling businesses will be needed as we emerge, slowly, from the coronavirus / covid-19 crisis.

Find books on Pandemics, Sustainable Energy, Esoteric Spirituality and many other topics at our sister site: Cherrybooks on Bookshop.org

Enjoy Lynxotic at Apple News on your iPhone, iPad or Mac or subscribe to our newsletter.

Lynxotic may receive a small commission based on any purchases made by following links from this page.