Business

There’s more to Money than Dead Presidents: Crypto is Alive and Well

Published

3 years agoon

Above: photo – Dead Presidents Collage – Lynxotic

Haters like Buffet and Mark Cuban’s cheerleading are off base and spreading confusion

Disclaimer first: This opinion article is not investment advice and does not advocate buying any investment vehicle or currency

There are so many misconceptions propagated far and wide these days that it’s hard to choose a place to start. First it’s important to recognize that crypto currencies are not stocks or companies, yes that’s obvious but one of the biggest “anti” argument these days is that there’s an absurdity to the aggregate total value of a “coin” being more than the market cap of the stock of a particular company.

“Ethereum is now worth more than Bank of America”, this nonsense comparison goes, as if the market cap of a stock and the price of a coin times the number of coins in existence has any meaning whatsoever.

Following this logic, however, beneath all the hype, both pro-crypto and anti-crypto, lies a hidden thread to an actual underlying truth.

Though based on obvious common sense, this thread is potentially confusing and convoluted, to say the least. But without seeing it clearly the misconceptions will just keep getting more ridiculous.

In order to illustrate the conundrum a bit of background is needed. For example:

Stocks, in the US are priced in dollars. But how are dollars priced? Isn’t just as accurate to say that when the “price” of the DJIA moves higher (3,4050 at this writing) it is the value of the dollar, in relation to the DJIA that went down?

While this requires a kind of mental gymnastics, these are only due to the constant bombardment meant to keep you from seeing this 100% valid way of viewing stock valuations based in dollars.

There’s another kind of tacit misinformation and that is stating that “inflation” is only relevant when it’s measured by the government. For example if the “bull market” that began in 2009 and continues into 2021 represented a huge increase in stock prices, that is asset inflation.

The inverse of asset inflation is a reduction in dollar value. Less shares of a given stock can be bought for the same number of dollars. The dollars are worth less.

Read more:

- Underrated: Stephen Curry Biopic Live on Apple TV+

- Boffo Barbenheimer: Toy of Triumph and Top Bomb Flick Debut

- Resilience, Adaptation, and Survival: How the Future is Shaped by the Names we Choose

And further, crypto, such as BitCoin is measured as having more or less value in dollars. Who is to say the massive rise in the dollar “value” of BitCoin is not representative of a decline in the “intrinsic” value of dollars.

The truth is often hidden in plain sight and that is what drives traditional markets

And that is precisely the point. BitCoin’s existence, which is locked in the mind of Satoshi Nakamoto (if he indeed exists) was indicated cryptically (no pun intended) to be a kind of answer to the instability of the global financial system as was evidence in the crisis of 2008. Taking place nearly concurrently with the birth of the idea of BitCoin.

Seeing the dollar as having a “stable” value and measuring a companies value, via it’s share price, is, let’s just say, perhaps 100 times more absurd than the Dogecoin dog.

Why? Because, for nearly a century the dollar is not backed or moored to anything but the government’s hope that it will retain value and laws that prohibit you and I from using other vehicles as “legal tender”.

The data (and opinions) on this are seemingly endless and yet absolutely critical to understanding our monetary system and where crypto may or may not fit in.

Horseshoe Nails and The Isle of Yap

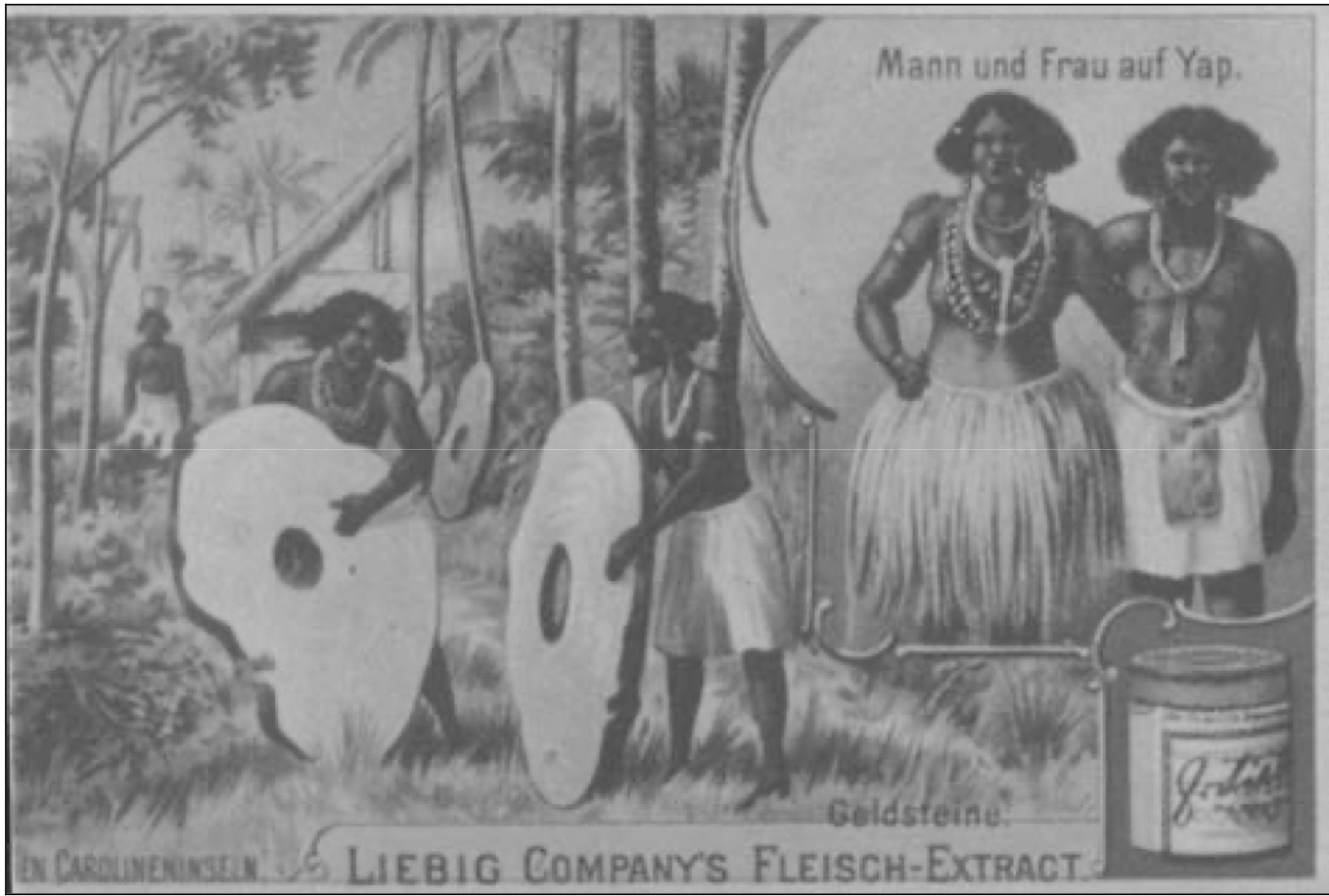

Many interesting historical facts point toward the reality that money and coinage has always been just as much about the abstract belief in the system, more than any particular “intrinsic” value.

On the Micronesian Isle of Yap there was a functioning monetary system based on huge stones. A New York Times article, published in 1971 described the curious system:

“Every piece has an owner, and everyone knows who the owner is. Even when the money changes hands, it usually stays put. Yapese stone money is the largest and heaviest “coin” in the world.

In earlier days, brave islanders paddled by canoe 300 miles across open ocean to Palau where they cut slices from huge stalactites and brought them back as money. The value depended on how many men were drowned bringing them back. Nowadays, value is usually determined by measurements. We heard various versions, ranging from $10 radial inch to $42 a foot.”

Another article explains that many “wealthy” home (hut) owners displayed their money by leaving it leaning against the front of the house, where all could see the prosperity.

And, as for the prevention of fraud and corruption in any monetary system? Could any be more corrupt than the one that led to credit default swaps and mortgage-backed securities imploding and all the BS that nearly brought down the world’s banking system?

And that is not new either. In the 1800s traveling bank examiners journeyed throughout the US to check on the gold reserves claimed by various banks. More often than not, they found far less gold than was claimed (in today’s fractional banking system little attempt is made to reduce the leverage in the system).

A common, clever, trick to try to “leverage” what little gold was actually on hand was to pile gold coins and ingots on top of a bed of horseshoe nails, hoping that the examiner would weigh the entire concoction only, and never notice the bogus hidden attempt to bolster the weight.

Bitcoin’s system at least attempts to circumvent this typically human brand of fraud and corruption.

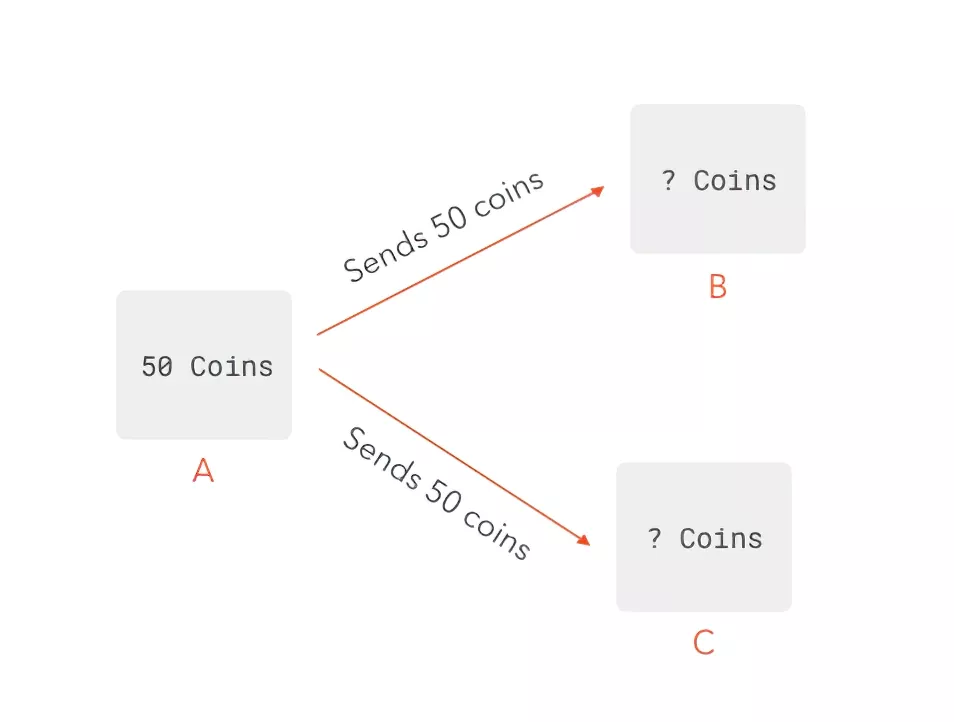

In the article “What is Cryptomining” on Techspot a chart was published to illustrate how Satoshi Nakamoto tried to solve the classic trust delimma with the proof of work mining system.

“For example, if Alice has $100 at the beginning of the day, she could promise Bob, Charlie, and David independently that she’d send them each $100 by the end of the day. While Alice could show them that she owns $100 and they’d all be content and agree to the transaction, Alice only has $100. Thus, if at the end of the day, the public ledger (which once finalized is set in stone, so to speak) includes 3 transactions initiated by Alice for $100, the system would be broken and no one would want to use it.

With a centralized system such as in modern day banks, there would exist a single ledger that can validate how much money a certain individual has, and thus it can guarantee that the customer cannot spend more than they own. When talking about a decentralized, peer-to-peer system, however, who’s there to stop a clever individual from spending their money multiple times quickly before getting caught?

To address this potential issue, crypto miners enter the playing field. Essentially, miners play the role of the decentralized banker, and will perform the required gruntwork to ensure that the system is functioning as expected without double-spending. In return for their work, they will be rewarded with some cryptocurrency.”

Buffet, Cuban, Musk & Munger

In clonclusion, Buffet, Munger and The Wall Street Journal may have knowledge and experience but they have also derived benefit from a system that favors those already holding capital, one that also has a tendency to crush those trying to build it.

So, it’s fairly obvious that they are “talking their book” and data mining to produce a self-congratulatory outcome, when they expound on all the reasons that they hate crypto (Munger even called it “disgusting”).

Recent Articles:

- What if “Non-human Biologics” are Watching?

- ‘Most Significant Charges Yet’: Trump Indicted for Trying to Overturn 2020 Election

- But what am I?’ Pee-wee Herman creator and star, Paul Reubens dead at 70

- The Congressional Hearing On UFOs Confirmed the Existence of Aliens? Maybe

As for Musk and Cuban, what’ve they got to lose? At least they “get it”, at least they are open to the idea of a future that has crypto as a part of the financial system. But where will they stand if there is government resistance in a big way, and if attempts to stop the entire crypto movement or “de-fang” it in ways that make it less viable as a true alternative to the status quo? That, my friend, will be the 1000 BitCoin question.

Find books on Music, Movies & Entertainment and many other topics at our sister site: Cherrybooks on Bookshop.org

Enjoy Lynxotic at Apple News on your iPhone, iPad or Mac.

Lynxotic may receive a small commission based on any purchases made by following links from this page