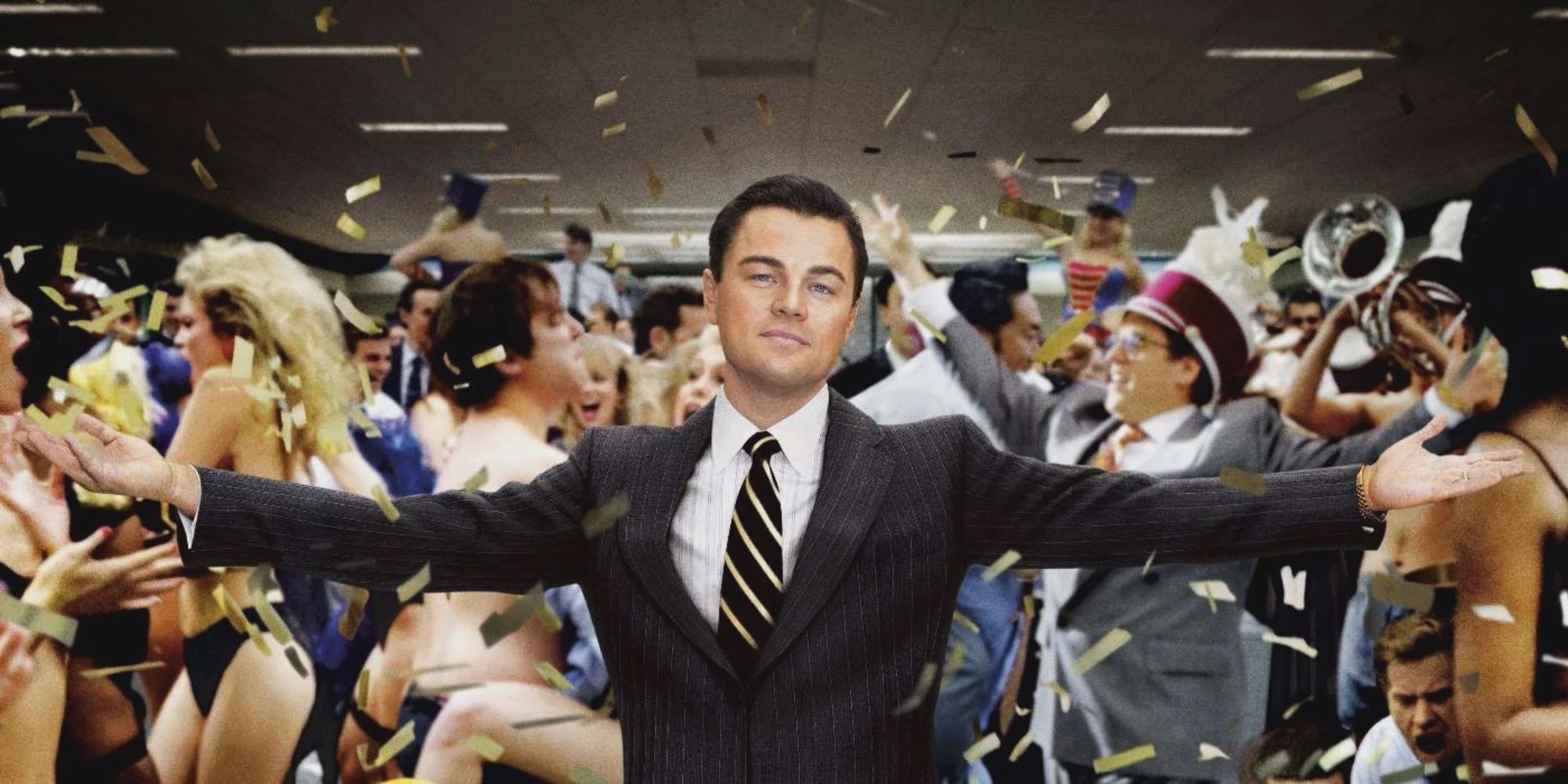

Want know more about shorting? About the shady and complicated scams? And also see an incredible film?

The Wolf of wall street is simply a great movie. It’s even better though if you watch it in the context of stock market mania. Just like the one that’s happening now.

Beyond the fact that the story is incredibly entertaining it does also get into the heart of the “pump & dump” boiler room mentality. While the so called ‘retail investors” who are riding the Robinhood stock purchasing app to what they see as well deserved revenge on Wall Street, and Belfort who was the real life “Wolf of Wall Street” was more of a wannabe that couldn’t get into the establishment. He then set forth, with chutzpa and insanity and some drugs, built his own criminal empire, there are some very clear correlations between his tricks that made him rich and what the short-squeezing Reddit & Wall Street Bets chat room vigilantes are doing right now.

Read more: Confused about GameStop, Robinhood, Reddit and Wall Street Bets? Check out the Big Short

Can we all be like the guys, Jordan Belfort or Michael Burry, who was played by Christian Bale in the movie, and even though it was about going short, it’s sill ok, cause, Christian Bale?

Read more: GameStop, Dogecoin, Robinhood and Stonks: What’s going on!?

History does exist, even if it happened before your uncle was born

Up until 1934 many things were legal and rampant that today, technically, are not allowed. Insider Trading is the most obvious and best defined, look up Martha Stewart and jail time if you want to know more about that.

Collusion in the market is another less well known practice, also known as “pump & dump” that has as many variations as Ponzi schemes and, though illegal, will never be stamped out. The technical terms for Colluding in relation to stock trading are “securities fraud” or “market manipulation.”

Not to get technical but here’s an partial excerpt of the legal specifics:

15 U.S. Code § 78i – Manipulation of security prices

(a) – (2 To effect, alone or with 1 or more other persons, a series of transactions in any security registered on a national securities exchange, any security not so registered, or in connection with any security-based swap or security-based swap agreement with respect to such security creating actual or apparent active trading in such security, or raising or depressing the price of such security, for the purpose of inducing the purchase or sale of such security by others.

Read more: “GameStonks vs. Wall Street”: Heroes, Victims and Hogwash

Subscribe to our newsletter for all the latest updates directly to your inBox.

Find books on Music, Movies & Entertainment and many other topics at our sister site: Cherrybooks on Bookshop.org

Enjoy Lynxotic at Apple News on your iPhone, iPad or Mac.

Lynxotic may receive a small commission based on any purchases made by following links from this page.