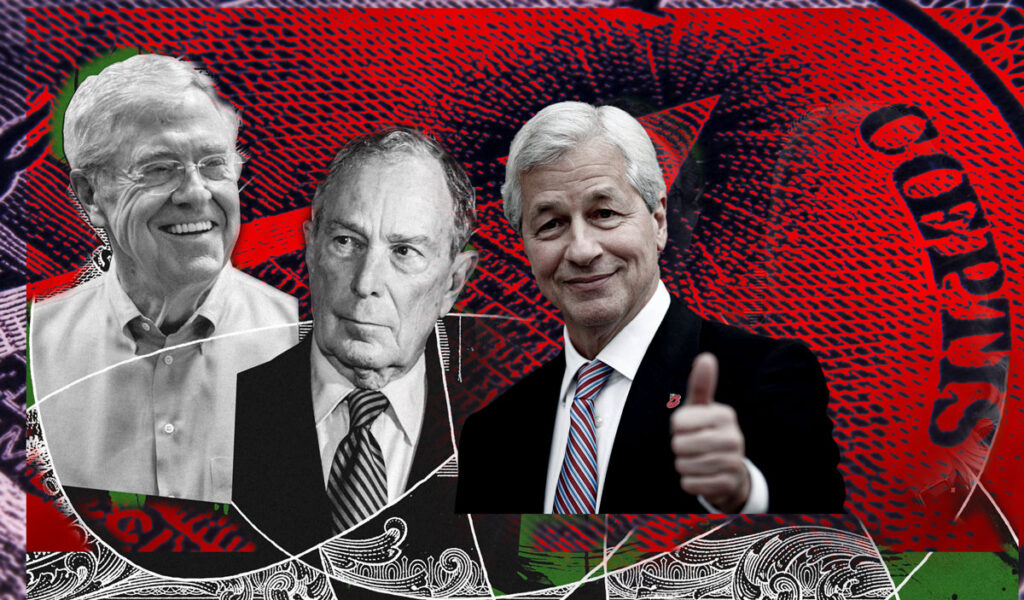

Early in 2020, as the pandemic gripped the nation, JPMorgan Chase offered to help customers weather the crisis by taking a temporary pause on mortgage, auto and credit card payments. Chase’s CEO, Jamie Dimon, sounded sympathetic about a year later as he offered broader reflections on what was ailing the country. “Americans know that something has gone terribly wrong,” he wrote in a letter to shareholders. “Many of our citizens are unsettled, and the fault line for all this discord is a fraying American dream — the enormous wealth of our country is accruing to the very few. In other words, the fault line is inequality.”

But even as those words were published, the bank had quietly begun to unleash a lawsuit blitz against many of its struggling customers. Starting in early 2020 and continuing to today, Chase has filed thousands of lawsuits against credit card customers who have fallen behind on their payments.

Chase had stopped pursuing credit card lawsuits in 2011, in the wake of the last major economic downturn, after regulators found that the company was filing tens of thousands of flimsy suits, sometimes overstating what customers owed. Rather than being backed by extensive billing records to document the debts, according to the regulators, the suits were typically filed with a short affidavit from one of a half-dozen Chase employees in one office in San Antonio who vouched for the accuracy of the bank’s information in thousands of suits.

Chase “filed lawsuits and obtained judgments against consumers using deceptive affidavits and other documents that were prepared without following required procedures,” the Consumer Financial Protection Bureau concluded in 2015. At times, Chase employees signed affidavits “without personal knowledge of the signer, a practice commonly referred to as ‘robo-signing.’” According to the CFPB’s findings, there were mistakes in about 10% of cases Chase won and the judgments “contained erroneous amounts that were greater than what the consumers legally owed.”

Chase neither admitted nor denied the CFPB’s findings, but it agreed, as part of a consent order, to provide significant evidence to make its cases in the future. The company also agreed it would provide “relevant information and documentation maintained by [Chase] to support their claims” in cases — the vast majority of those it filed — in which customers did not respond to the lawsuit.

But that provision expired on New Year’s Day 2020. And since then the bank has gone back to bringing lawsuits much as it did before 2011, according to lawyers who have defended Chase customers.

“From what I can see, nothing has changed,” said Cliff Dorsen, a consumer-rights attorney in Georgia who represents Chase credit card customers.

Chase declined to make executives available for interviews. It said in a statement that the timing of the resumption of its credit card lawsuits was just a coincidence. “We have engaged with our regulators throughout this process,” said Tom Kelly, a bank spokesperson. “We continue to meet the requirements of the consent order.” (Kelly said Chase also filed some credit card lawsuits in 2019.)

Kelly declined to say how many suits it has filed in its blitz of the past two years, but civil dockets from across the country give a hint of the scale — and its accelerating pace. Chase sued more than 800 credit card customers around Fort Lauderdale, Florida, last year after suing 70 in 2020 and none in 2019, according to a review of court records. In Westchester County, in New York’s suburbs, court records show that Chase has sued more than 400 customers over credit card debt since 2020; a year earlier, the equivalent figure was one.

A similar surge is occurring in Texas, according to January Advisors, a data-science firm. Chase filed more than 1,000 consumer debt lawsuits around Houston last year after filing only seven in 2020, the analytics firm’s review of court records in Harris County shows. Chase instigated 141 consumer debt cases in Austin last year after filing only one such case in 2020, according to January Advisors, which is conducting research for a nationwide study ofdebt collection cases.

Today, just as it did before running afoul of the CFPB, Chase is mass-producing affidavits from the same San Antonio office where low-level employees generated hundreds of thousands of affidavits in the past, according to defense attorneys and court documents. Those affidavits are often the main piece of evidence that Chase uses to win its case while detailed customer records — and any errors they may contain — remain out of sight.

“Our clients deserve to see everything that Chase has in its files,” Dorsen said. “Instead, Chase gives us these affidavits and says: ‘You can trust us about the rest.’”

Before the robo-signing scandal a decade ago, Chase recovered about a billion dollars a year with its credit card collections business, according to the CFPB. Why would Chase stop suing customers for years, forgoing billions of dollars, only to ramp up its suits once key provisions of the CFPB settlement had expired?

Craig Cowie thinks he has an answer. “Chase did not think it could make money if it had to sue customers and abide by the CFPB settlement,” said Cowie, who worked as an enforcement attorney at the CFPB during the Obama administration and now teaches at the University of Montana Law School. “That’s the only explanation that makes sense for why the bank would have held back.”

Cowie, who did not work on the CFPB’s case against Chase, said he doesn’t know why the agency agreed to a time limit on some settlement provisions. He pointed out that such agreements are negotiated and the CFPB cannot just dictate the terms. The agency may have felt it had to let some provisions of the settlement expire to get Chase to agree to the deal, Cowie said.

The CFPB declined to comment.

For its part, Chase said it waited years to restart its lawsuits because it took that long to get the system working right. “We rebuilt the litigation program slowly and methodically to make sure we had the right controls in place,” said its spokesperson, Kelly.

At the time, the CFPB had found numerous flaws in Chase’s suits. The agency concluded that Chase used “unfair” legal tactics when it promised that its credit card account information was reliable and mistake-free. It wasn’t simply a matter of errors in calculating how much was owed; in some cases the company even got the customer’s name wrong. Chase would sometimes pass accounts with errors — including instances where customers had been victims of credit card fraud, others who had tried to settle their debts and even some who had died — on to outside debt collectors, who might then take action based on that information.

Once Chase won a victory in court, the bank could seek to garnish a customer’s wages or raid their bank accounts, and those customers would pay a further price: a stain on their credit report that could make it harder to “obtain credit, employment, housing, and insurance,” the CFPB wrote.

Those sued by Chase, then and now, might spot errors if the company provided full records in its court filings, consumer advocates say. Instead, Chase typically submits copies of a few credit card statements along with a two-page affidavit attesting that the bank’s records were accurate and complete.

Consumer advocates say they do not expect that the majority of Chase’s credit card records are tainted with errors. But if today’s error rate is the same 10% that the CFPB estimated in the past and the Chase lawsuit push continues, thousands of customers may be sued for money they don’t owe. And there is no easy way to check when Chase keeps so many of its records out of sight.

Chase said that its current system for processing credit card lawsuits is sound and reliable. “We quality-check 100% of our affidavits today,” the company said in a statement.

Credit card customers do not respond to collections lawsuits in roughly 70% of cases, according to research from The Pew Charitable Trusts. In those instances, the customer typically loses by default.

In the small percentage of cases where a customer gets a lawyer or otherwise fights back, Chase still has the advantage because it can access all of the customer’s account records easily, according to consumer lawyers. (The bank typically closes accounts of customers who have failed to pay their debts, leaving them unable to access their records online.) Chase usually shares the complete credit card account file only after a legal fight, according to attorneys and pleadings from across the country. “Chase has all the evidence and we have to beg to get it,” said Jerry Jarzombek, a consumer-rights attorney in Fort Worth, Texas, who is defending several Chase customers.

The result leaves many defendants in a bind: They don’t have enough information to know whether they should dispute the company’s claims. “Chase wants us to believe its records are reliable so we don’t need to see them,” Jarzombek said. “Well, I’m sorry. I’ve dealt with Chase for decades. I’d prefer to see what evidence they’ve actually got.”

The robo-signing scandal exposed Chase’s affidavit-signing assembly line. Before the settlement, Chase had about a half-dozen employees churning through affidavits stacked a foot high or taller, according to the former Chase executive who brought the practices to light at the time. Kamala Harris, who was then California’s attorney general and is now vice president, likened the process to anaffidavit mill.

The current operation involves roughly a dozen “signing officers” working from the same San Antonio offices as before and performing many of the same tasks, according to Chase employees and outside lawyers who have represented the company.

Chase used to prepare affidavits “in bulk using stock templates,” according to the 2015 CFPB findings. That is again happening today, according to two of Chase’s outside lawyers who requested anonymity because they were not authorized to discuss the process.

The lawyers said they typically send their affidavit requests in batches. The requests already contain the basic details of the customer’s account when they arrive in Chase’s San Antonio office, they said. An affidavit request that is sent one day can typically be processed and returned the next business day, the lawyers said.

Chase affidavits contain stock language that the “signing officer” has “personal knowledge of and access to [Chase’s] books and records.” That “personal knowledge” is limited, said one signing officer who declined to be named. Chase does not expect signing officers to perform a forensic review of an account but rather to follow computer prompts to complete the affidavit, said the employee. “We just work with what’s on the screen.”

Chase declined to discuss its process for creating affidavits, but the bank said it satisfies the rules set by courts in the places where it operates. “Judges, clerks and other judiciary staff are well versed in the court rules and laws in their jurisdictions,” said the statement by the bank’s spokesperson, Kelly. “Through our counsel, we provide the information those parties require in matters before them.”

Courts around the country have grown too accepting of what big banks and debt collectors say, according to consumer advocates. And the justice they dispense can feel as cursory and hurried as the suits that Chase files.

In Texas a decade ago, lawmakers pushed most credit card cases into the state’s version of small claims courts, known as justice courts. The rules of evidence are more lax there and the judge might not even be a lawyer. A retired basketball player presides over one suchcourtroom in Houston. “One of these judges said to me: ‘What’s the point of seeing a bunch of evidence? We already know these people borrowed the money,’” said Jarzombek, the Fort Worth attorney. “I said: ‘Why even have a trial, then? Let the banks take whatever they want.’”

In Houston, where Chase has more than 1,000 consumer credit suits on the docket, only one defendant in those cases has fought to a trial on her own, according to court records.

That person’s experience is instructive. Like many, Melissa Razo struggled financially during the early pandemic. A former restaurant manager, the 42-year-old Razo had gone back to school, the University of Houston, to study psychology, and she supported herself by doing typing for an online transcription service. That work suddenly dried up when the pandemic hit, and Razo began missing credit card payments. Her debt escalated. Chase sued her in January 2021, claiming she owed a total of about $8,500 on two credit cards.

Razo had a previous court experience stemming from an acrimonious divorce, where she had learned that a plaintiff needs facts and evidence to win. “Nothing I presented was good enough,” she recalled of the divorce case.

Using what she’d learned, Razo prepared for her day in court against Chase. She could not access her account anymore, she said, because the bank had shut it down. So in late June, as her hearing date approached, Razo pulled together as many of her credit card statements as she could find. They told a story of grocery runs and shopping at Target and Goodwill, along with missed payments and penalties.

Razo presumed Chase would have to back up its claims just as she had been expected to do in divorce court. She expected the company’s lawyers would have five years of statements and documents to show that she owed exactly what they said she owed. This was a trial, after all.

The trial lasted perhaps a minute, according to Razo. It boiled down to two questions. Was Razo present? the judge asked over Zoom. When she announced herself, the judge asked if she had a Chase credit card. Yes, Razo said, that was true. Then, she said, the judge ruled in favor of Chase.

Chase declined to comment on the case. The judge was not authorized to speak about the matter, according to a court clerk. And the justice courts do not transcribe their hearings, so ProPublica could not verify what was said. (The court’s docket did confirm that a judgment was entered in Chase’s favor after a judge trial.)

Razo’s courtroom experience, though, sounds typical, according to Rich Tomlinson, a lawyer with Lone Star Legal Aid. “I can’t recall ever seeing a live witness in a debt case,” said Tomlinson, who has represented hundreds of debtors in his career. “These trials are not like Perry Mason. They’re not even Judge Judy.”

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Originally published on ProPublica By Patrick Rucker, The Capitol Forum and republished under a Creative Commons license CC BY-NC-ND 3.0).

Related Articles:

- What if “Non-human Biologics” are Watching?

- ‘Most Significant Charges Yet’: Trump Indicted for Trying to Overturn 2020 Election

- But what am I?’ Pee-wee Herman creator and star, Paul Reubens dead at 70

- The Congressional Hearing On UFOs Confirmed the Existence of Aliens? Maybe

- The Earthly Frontier: Building a Sustainable Future at Home

Find books on Music, Movies & Entertainment and many other topics at our sister site: Cherrybooks on Bookshop.org