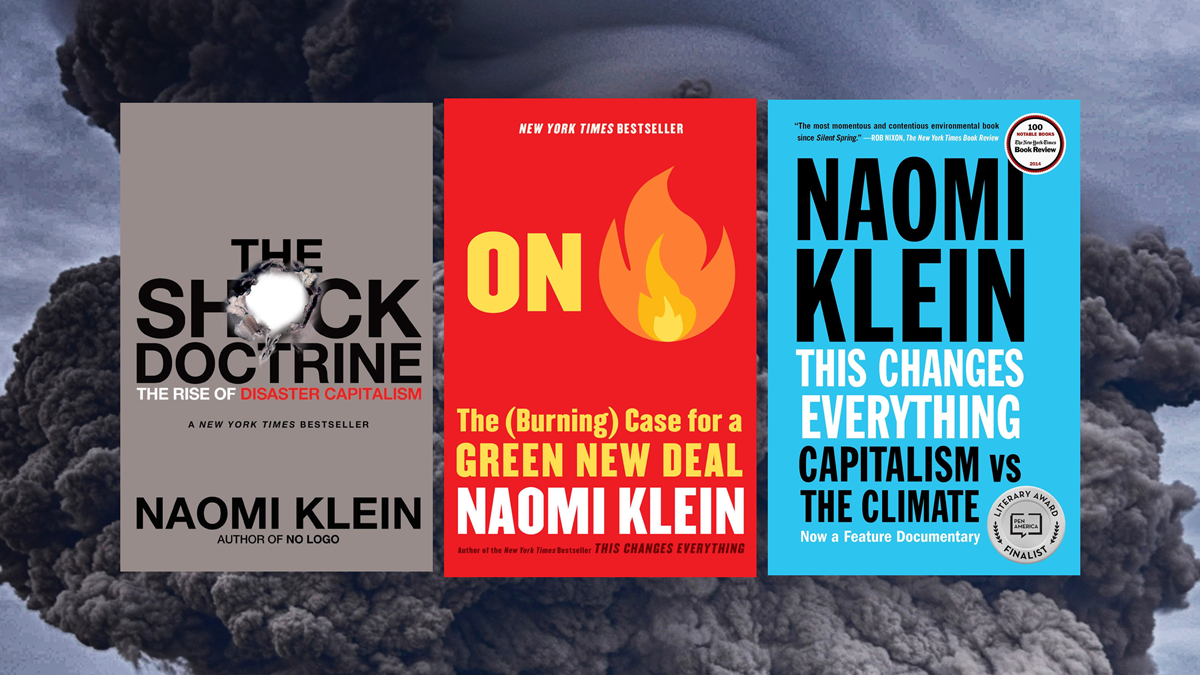

Above: Photo Collage / Lynxotic / Simon & Schuster

Naomi Klein’s new book is third in a venerated series on problems we face as a species

As the disasters mount and more and more are definitively linked to man-made climate change and global warming, millions around the globe recognize the need for solutions. More and more the solutions arise, only to be blocked or derailed by the same phenomena: corrupt governments beholden to status quo power and short-sighted corporate greed.

This dynamic; available solutions being actively opposed by business and governments that answer to those powerful corporate entities, even as they mount massive multi-million dollar ad campaigns to “green-wash” their image and try to appear aligned with the very solutions they violently oppose is nearly all pervasive.

Meanwhile, as the problems continue to grow, it has become clear that we, that is to say humanity and its future survivors, are not just fighting a battle against the problem itself, the rapidly deteriorating climate caused by Carbon dioxide (CO2), the primary greenhouse gas emitted through human activities, but even more so a political battle is underway which pits an entire entrenched, unequal and corrupt system (regardless of ideology) against the very issue that needs to be tackled in order for our species to survive.

Without solving the problem of Capitalism’s built-in bias toward profit at any cost, any solution to the climate crisis will be stopped or hindered before it can take root and make enough impact to give us a chance against the looming disasters.

Recently Greta Thunberg posted a statement that governments were literally doing nothing, while at the same time preaching and advertising their “commitment” to solving the problem.

Naomi Klein represents a voice, a top selling author, that has stayed focused on this specific aspect of the challenge for decades. The documentary based on her best-selling book “This Changes Everything” (trailer below) is now a classic and zeros in on the monumental importance of this problem, and how the political and economic systems of the world will require massive and immediate change if we are to survive.

This is not about the tired tropes of Socialism vs Capitalism vs Communism and so on, but rather about the specific corruption and suicidal deception that threatens us all, as fake dedication to solving the problem is paraded simultaneously with efforts that double-down on protecting the homicidal status quo of greed and destruction.

Now, with the Biden administration touting its green status and the green new deal, there must be accountability and more than just words and slogans. The new book shown below is an in-depth look at just what needs to happen to confront the political gridlock and the tendency for real solutions to be blocked or destroyed in the crib.

On Fire: The (Burning) Case for a Green New Deal

Naomi has been at the forefront reporting on the many ways the economy has waged war one planet and people for over 20 years.

An instant bestseller, On Fire shows Klein at her most prophetic and philosophical, investigating the climate crisis not only as a profound political challenge but also as a spiritual and imaginative one. Delving into topics ranging from the clash between ecological time and our culture of “perpetual now,” to the soaring history of humans changing and evolving rapidly in the face of grave threats, to rising white supremacy and fortressed borders as a form of “climate barbarism,” this is a rousing call to action for a planet on the brink. An expansive, far-ranging exploration that sees the battle for a greener world as indistinguishable from the fight for our lives, On Fire captures the burning urgency of the climate crisis, as well as the fiery energy of a rising political movement demanding a catalytic Green New Deal.

Within this text, you will find her essays, written whilst in the midst of natural disasters, dire warnings of the future that is waiting for us if we do nothing to change. The long-forms essays display both the prophetic and philosophical while also challenging the spiritual and imaginative.

Her writings span events ranging from the smoky skies of the Pacific Northwest, the barren Great Barrier Reef to the post-hurricane Puerto Rico and many other climate crises.

This Changes Everything: Capitalism vs. the Climate

Author Naomi Klein wants readers to embrace the radical, that there is no longer the option to remain at the status quo. Climate Change isn’t just something to be “fixed” it is a crisis that requires immediate action. Also now a feature documentary.

In her book she exposes climate change deniers, delusions of geoengineers, why mainstream green initiatives have failed thus far and how capitalism will only make things worst.

The most important book yet from the author of the international bestseller The Shock Doctrine, a brilliant explanation of why the climate crisis challenges us to abandon the core “free market” ideology of our time, restructure the global economy.

The Shock Doctrine: The Rise of Disaster Capitalism

Klein introduces us to a new term, disaster capitalism, how those who experience catastrophic events (i.e. war/extreme violence or tsunami/ natural, ect) not only had to suffer from the disaster but also were being taken advantage by “rapid-fire corporate makeovers”.

“The Shock Doctrine” shows how economic policies have capitalized on crises, how at the core of disaster capitalism is to use a cataclysmic event to radicalize privatization.

In her groundbreaking reporting, Naomi Klein introduced the term disaster capitalism. Whether covering Baghdad after the U.S. occupation, Sri Lanka in the wake of the tsunami, or New Orleans post-Katrina, she witnessed something remarkably similar. People still reeling from catastrophe were being hit again, this time with economic shock treatment, losing their land and homes to rapid-fire corporate makeovers.

The Shock Doctrine retells the story of the most dominant ideology of our time, Milton Friedman’s free market economic revolution. In contrast to the popular myth of this movement’s peaceful global victory, Klein shows how it has exploited moments of shock and extreme violence in order to implement its economic policies in so many parts of the world from Latin America and Eastern Europe to South Africa, Russia, and Iraq.

Watch Trailer for Documentary: ‘This Changes Everything’

Find books on Sustainable Energy Solutions and Climate Science and many other topics at our sister site: Cherrybooks on Bookshop.org

Enjoy Lynxotic at Apple News on your iPhone, iPad or Mac.

Lynxotic may receive a small commission based on any purchases made by following links from this page