As a member of Congress, Jared Polis was one of the loudest Democrats demanding President Donald Trump release his tax returns.

At a rally in Denver in 2017, he warned the crowd that Trump “might have something to hide.” That same year, on the floor of the House, he introduced a resolution to force the president to release the records, calling them an “important baseline disclosure.”

But during Polis’ successful run for governor of Colorado in 2018, his calls for transparency faded. The dot-com tycoon turned investor broke with recent precedent and refused to disclose his returns, blaming his Republican opponent, who wasn’t disclosing his.

Polis may have had other reasons for denying requests to release the records.

Despite a net worth estimated to be in the hundreds of millions, Polis paid nothing in federal income taxes in 2013, 2014 and 2015. From 2010 to 2018, his overall rate was just 8.2% — less than half of the 19% paid by a worker making $45,000 in 2018.

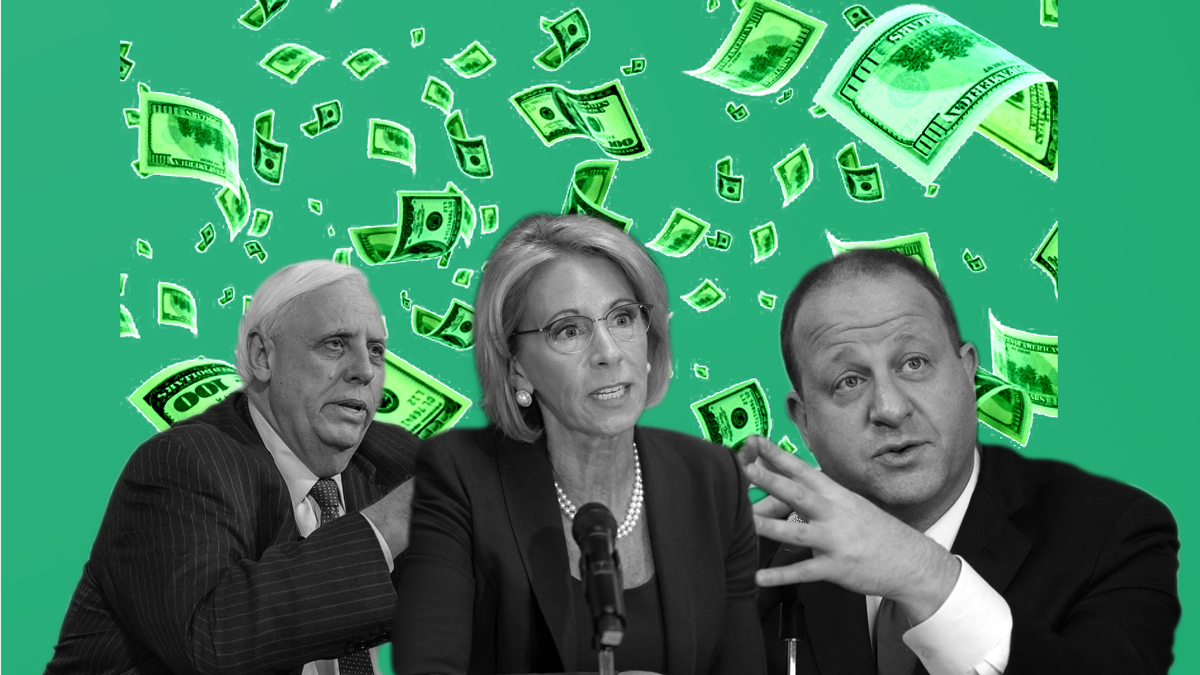

The revelations about Polis are contained in a trove of tax information obtained by ProPublica covering thousands of the nation’s wealthiest people. The Colorado governor is one of several ultrarich politicians who, the data shows, have paid little or no federal income taxes in multiple years, exploited loopholes to dodge estate taxes or used their public offices to fight reforms that would increase their tax bills.

The records show that rich Democrats and Republicans alike have slashed their taxes using strategies unavailable to most of their constituents. Among them are governors, members of Congress and a cabinet secretary.

Richard Painter, the chief White House ethics lawyer during the George W. Bush administration, said the tax avoidance of these top politicians is “very, very worrisome” since both parties “spend like crazy” and depend on taxes to fund their priorities, from the military to Medicare to Social Security.

“They have the power to decide how much the rest of us pay and the power to spend the money, and then they’re not paying their fair share?” Painter said. “That should be troubling to voters, both conservative and liberal. It should be troubling for everyone.”

West Virginia Gov. Jim Justice, for example, is a Republican coal magnate who has made the Forbes list of wealthiest Americans. Yet he’s paid very little or no federal income taxes for almost every year since 2000.

California Rep. Darrell Issa, one of the richest people in Congress, was one of the few Republicans to break with his party during the 2017 tax overhaul to fight for a deduction that — unbeknownst to the public — helped him avoid millions in taxes.

And the tax records of Republican Sen. Rick Scott of Florida and Trump’s education secretary, Betsy DeVos, showed that both employed a loophole, which was accidentally created by Congress, to escape estate and gift taxes.

As ProPublica has revealed in a series of articles this year, these tactics, if sometimes aggressive, are completely legal. And they’re not universal among wealthy politicians. ProPublica reviewed tax data for a couple dozen wealthy current and former government officials. Their data shows that many of them paid relatively high tax rates while employing more modest use of the fairly standard deductions of the rich.

The politicians who paid little or exploited loopholes either defended their practices as completely proper or declined to comment.

“The Governor has paid every cent of taxes he owes, he has championed tax reform and tax fairness to fix this broken system for everybody, to report otherwise would be inaccurate,” Polis’ spokesperson wrote in an email.

During the late 1990s dot-com era, Polis earned a reputation as a boy wonder. He turned his parents’ small greeting card company into a website, bluemountain.com, which was among the first to enable users to send free virtual cards. He and his family sold the site in 1999 for $780 million.

With the windfall from the sale, Polis continued to start new ventures and invest, but he also began laying the groundwork for a career in politics. He landed in the governor’s office in 2019 when he was just 43.

One of his tools for raising his profile was philanthropy. His generous donations to charity became a theme of both his 2008 run for Congress and his 2018 run for Colorado’s highest office.

Philanthropy also helped keep his tax rate enviably low. In many years, the deductions he claimed for his charitable giving were large enough to wipe out half the income he would have owed taxes on. His giving allowed him, in essence, to take some of the money he would have paid into the public coffers and donate it instead to causes of his choosing.

But an examination of Polis’ philanthropy shows that while he has given to a wide variety of causes, some of his donations served to promote him, blurring the lines between charity and campaigning.

According to the tax filings of his charity, the Jared Polis Foundation, the organization spent more than $2 million from 2001 to 2008 on a semiannual mailer sent to “hundreds of thousands of households throughout Colorado” that was intended to build “on a foundation of familiarity with Jared Polis’ name and his support of public education.” It was one of the charity’s largest expenditures.

A 2005 edition of the mailer reviewed by ProPublica had the feel of a campaign ad. It was emblazoned with the title “Jared Polis Education Report,” included his name six times on the cover and featured photos of Polis, a former state board of education member, surrounded by smiling school children.

The newsletters were discontinued just as he was elected. Because the mailers did not explicitly advocate for his election, they would have been legally allowed as a charitable expenditure.

A decade later, when he ran for governor in a race that he personally poured more than $20 million into, Polis featured his philanthropy in his campaign. In one ad, he used testimonials from an employee and a graduate of a business training charity he founded for military veterans.

Polis’ spokesperson, Victoria Graham, defended the mailers, saying they were intended “to promote innovations and successful models in public education and to raise awareness for the challenges facing public education.” She also pointed to a range of other philanthropy Polis was involved in, from founding charter schools, which she noted were not named after him, to distributing computers to organizations in need.

“His philanthropy is not and has never been motivated by receiving a tax write-off, and to state otherwise is not only inaccurate but fabricating motives and intent and cynical in its view of charity,” Graham said.

While Polis’ charitable giving has helped keep the percentage of his income he pays in taxes low, he has also been able to keep his total taxable income relatively small by using another strategy common among the wealthy: investing in businesses that grow in value but produce minimal income.

It sounds counterintuitive, but it’s a basic principle of the U.S. tax system — one that typically benefits wealthy people who can afford not to take income. Investments only trigger income taxes when they produce “realized” gains, such as dividends from a stock holding, the sale of an asset or profits from a company. But an investment’s growth in value, while it makes its owner richer, is not taxable.

Polis acknowledged his use of the strategy in 2008 after he released tax information during his first run for Congress and faced criticism for paying so little in taxes. “I founded several high-growth companies, and we would manage those for growth rather than for profit,” he said. “When I make money, I pay taxes. When I don’t make money, I don’t.”

In one of the recent years Polis paid no income taxes, his losses were larger than his income. In two of the years, it was about a million dollars. From 2010 to 2018, when he paid an overall rate of just 8.2%, including payroll taxes, his income averaged $1.5 million.

During that period of low taxes and relatively low income, Polis’ estimated net worth rose sharply. Members of Congress only have to report the value of each of their assets in ranges, so assigning a precise number is impossible. But the nonprofit data site OpenSecrets, which makes estimates by taking the midpoint of the ranges, shows Polis’ wealth growing from $143 million in 2010 to $306 million in 2017, making him the third richest-member of the House at the time. (Graham said congressional disclosure forms are confusingly formatted, potentially causing certain assets to be counted more than once, “so these numbers are likely wildly off.” She did not provide alternative net worth figures.)

One of Polis’ primary vehicles for building his fortune, while avoiding taxable income, appears to have been a family office, Jovian Holdings. The board of directors included his father, sister and a rather surprising outsider: Arthur Laffer. The famed conservative economist’s Laffer Curve provided the Reagan administration with the intellectual basis for arguing that cutting taxes would increase tax revenue. (Polis’ sister is a ProPublica donor.)

The term family office has a mom-and-pop feel, but it is actually part of the infrastructure of protecting the fortunes of the ultrawealthy, from crafting investment and tax strategy to succession and estate planning to concierge services. Depending on how they’re organized, for instance as a business, their costs — the salaries of the staff, rent — can be deductible.

One of the executives at Polis’ family office, according to her LinkedIn profile, is a seasoned tax expert who specializes in “maximizing cost savings both operationally and with all taxing authorities.” She removed that detail around the time ProPublica approached Polis about his taxes.

Unlike ordinary investors, Polis was able to claim millions in deductions for some of the costs of his money management, specifically his family office, which contributed to lowering his tax burden. Ironically, the investment apparatus that helped Polis avoid taxable income became a tax break.

ProPublica discussed the scenario, without naming Polis, with Bob Lord, tax counsel for the advocacy group Americans for Tax Fairness. He said the public appears to be essentially subsidizing Polis’ investing while getting little in return. With a typical business, he said, you get the tax break but also relatively quickly make taxable income.

The costs of a family office are “being taken even though the income may be way out in the future. It’s just a giveaway,” Lord said. “What is the public getting from it? This really, really rich politician gets to shelter his income while his investments grow and doesn’t pay tax on it until he sells.”

Deferring paying taxes is a valuable perk. But the strategy, Lord said, may allow Polis an even more lucrative outcome. Now that Polis has made his fortune, he may be able to largely dodge the tax system forever. Should he die before selling his investments, his heirs would never owe income taxes on the growth.

Graham acknowledged that the tax system unfairly benefits the wealthy but said Polis is not purposely avoiding income that would result in taxes.

“The Governor has long championed tax reforms precisely because the income tax is inadequate and a mismatched way to tax most wealthy people who do not have a regular income but who make money in other ways and should be taxed,” she said. “Since 2006, Governor Polis has paid over $20 million in taxes on the money he earned on his gains and he has championed tax reforms that would lower the tax burden on middle-income earners and eliminate loopholes to ensure higher earners pay their share.”

ProPublica’s data shows that at least two federal officials have already taken steps to preserve their family fortunes for their heirs, exploiting loopholes that divert revenue from the federal government.

Scott, the Florida senator who ran one of the world’s largest health care companies, and DeVos, Trump’s education secretary and believed to be the richest member of his cabinet, have both stored assets in grantor retained annuity trusts — a form of trust used to avoid gift and estate taxes.

GRATs, as they’re commonly known, were accidentally created by Congress in 1990. Lawmakers were trying to close another estate tax loophole and in doing so unintentionally paved the way for another one. The lawyer who pioneered the trusts estimated in 2013 that they had cost the federal government about $100 billion over the prior 13 years.

To use this tax-avoidance technique, you put an asset, like stocks or real estate, into a trust assigned to your heirs. The trust pays you back the starting value of the asset (plus some interest). If the original asset rises in value, the gains can go to your heirs tax-free.

GRATs have become widely used among the superrich. A ProPublica investigation found that more than half of the nation’s richest individuals have employed them and other trusts to avoid estate taxes.

It’s unclear from ProPublica’s data how much DeVos, 63, and Scott, 68, were able to transfer tax-free.

DeVos and her husband employed a GRAT from at least 2000 to 2003. DeVos’ father was a wealthy industrialist. Her husband was the president of Amway, a multilevel marketing company that focuses on health, beauty and home products. Her family is believed to be worth billions.

Her causes both before and during her time in government depended on tax dollars. As a donor and fundraiser for Republican causes, she pushed for charter schools and government subsidies to allow parents to send their kids to private schools. As education secretary, she pushed to send millions of federal dollars intended for public schools to private and religious schools instead.

Scott, one of the wealthiest senators, with a net worth likely in the hundreds of millions, used a GRAT for much longer, from at least 2001 through 2009. His tax data shows the assets in the trust — stakes of a private investment fund and family partnership he and his wife created — receiving millions in income.

When he was in the private sector, Scott benefited from federal programs like Medicare, which are funded by taxes. He built and ran Columbia/HCA, a massive chain of for-profit hospitals. After a fraud investigation became public, he resigned and the company paid $1.7 billion to settle allegations it overbilled government health programs. Scott has previously emphasized that he was never charged, though he acknowledged the company made mistakes.

Scott declined to comment. Nick Wasmiller, a spokesman for DeVos, said she “pays her taxes in full as required by law. Your ‘reporting’ is not only factually wrong but also doubles-down on the criminal actions that underpin ProPublica’s political campaign to prop up the Biden Administration’s failing agenda.”

California Congressman Darrell Issa was one of a handful of Republicans who bucked his party in 2017 and voted against Trump’s tax overhaul.

Issa said he opposed the legislation because it all but eliminated the deduction taxpayers could take on their federal returns for state and local taxes. That provision was particularly contentious in high tax blue states like California, but most Republicans from his state still fell in line. The other GOP congressman in the San Diego area, for example, voted yes.

Limiting the write-off, known as the SALT deduction, was one of the few progressive changes in the Trump tax law. The deduction had long disproportionately benefited the wealthiest because they pay the most in state and local taxes. According to one projection, if the cap were removed from the deduction, households with income in the top 1% would reap the most benefit, paying $31,000 less a year on average — amounting to more than half of the total taxes avoided through the write-off. The top 25% of households would average less than $3,000 in savings a year, and the savings drop precipitously from there, with most households deriving no benefit.

In interviews and public statements, Issa said in fighting to preserve the deduction, he was defending the interests of middle-class taxpayers. “I didn’t come to Washington to raise taxes on my constituents,” he said at the time, “and I do not plan to start today.”

It’s true that more than 40% of taxpayers in Issa’s former district, a relatively affluent swath of Southern California, were able to make at least some use of the deduction.

But the 68-year-old congressman, who made a fortune in the car alarm business, was in the top echelon of its beneficiaries. Between 2003 and 2017, his tax data shows, Issa generally paid a relatively high tax rate but was able to claim more than $51 million in write-offs thanks to the SALT deduction, an average of more than $3 million a year.

By contrast, households in his district that made between $100,000 and $200,000 and took the SALT deduction claimed an average of $14,843 in 2017.

Issa’s spokesman, Jonathan Wilcox, declined to say if the SALT deduction’s impact on the congressman’s taxes factored into his decision to advocate for it.

“So much stupid,” Wilcox said. “Be sure to write back if you ever do better than trolling for garbage.”

Gov. Jim Justice is believed to be the richest person in West Virginia, controlling vast reserves of valuable steelmaking coal and owning The Greenbrier luxury resort. He made an appearance in 2014 on the Forbes list of 400 wealthiest Americans. Estimates of his net worth have ranged from the hundreds of millions to well over a billion.

Nonetheless, he’s paid little or no federal income taxes for almost every year between 2000 and 2018, ProPublica’s trove of tax records shows. In 12 of those years he paid nothing, and in all but two of those years, his rate didn’t exceed 4%.

His largest tax payment came in 2009, when his family sold off much of its mining holdings to a Russian company for more than half a billion dollars. That year, after deductions, his tax rate rose to a modest 13.4%.

In more recent years, Justice, 70, has reported tens of millions in losses each year. That not only helped him to minimize his federal income taxes, it also allowed him to apply those losses to his profits from previous years — and get refunds for the taxes he initially paid in those years.

Justice’s income was low enough in 2018 for his family to qualify for and receive a $2,400 coronavirus stimulus check, aid meant for low- and middle-income Americans.

The recent years of large losses reported on Justice’s tax returns have coincided with real signs of financial problems. The coal industry’s fortunes have rapidly declined. He’s been hounded for unpaid bills and loans. The Russian company that bought much of his coal empire sued him and got him to buy back the assets — at a much discounted price but attached to significant debt. Forbes knocked him off its wealth ranking, citing escalating battles with two major lenders over unpaid debt. Justice’s representatives have said he pays what he owes, and his business empire is in good shape.

But even before his empire began showing significant cracks, Justice was reporting losses or little income for a man so wealthy. From 1996 to 2008, Justice, who received a coal and farming fortune from his father, who died in 1993, either reported losses to the IRS or just a few hundred thousand dollars in income.

The disconnect could be explained by the generous deductions afforded to coal business owners.

For example, owners are allowed a depletion deduction, which allows them to take 10% of the revenue from coal they extract and write it off against their profit. This spin on depreciation can have outsized benefits because unlike normal depreciation — in which the write-offs are based on how much you paid for an asset — the write-off amount here faces no such limit, and can therefore exceed the initial investment. The deduction has been criticized by environmentalists and congressional Democrats as an overly generous giveaway.

Another benefit coal owners get is the ability to immediately expense much of their mine development costs on their taxes instead of being forced to stretch such deductions over a longer period of time. Justice has said that in the 15 years after his father’s death, he oversaw “a massive expansion of multiple businesses which included significant coal reserve expansion” — development that could have provided him with a significant stockpile of such write-offs. (ProPublica has previously reported on other generous write-offs. Sports team owners, for example, are allowed to deduct the value of their intangible assets — such as media deals and franchise rights — as wasting assets, even as they rise in value.)

Experts said this could explain how Justice could have reported negative income of $15 million in 2008, a year in which Mechel, the Russian company that subsequently bought much of his family’s coal empire, said that business alone produced about $94 million in EBITDA — a common measure of a business’ profitability before taxes and some other expenses.

Justice declined to answer a list of specific questions about his taxes. In a statement, his lawyer, Steve Ruby, said Justice “has paid millions upon millions of dollars in state and federal income taxes and has always followed the law. In many years, his businesses have suffered losses as the result of weak coal prices combined with substantial outlays to save jobs at local businesses that other companies were abandoning.

“When many other coal producers were filing for bankruptcy, the Justice companies persevered and refused to take the easy way out through a bankruptcy proceeding, a decision that contributed to those losses. Like any other taxpayer, Gov. Justice does not owe income taxes in years in which his income is negative,” the statement read.

Ruby confirmed that Justice received coronavirus stimulus checks but said he did not cash them.

Like Scott and DeVos, Justice has used GRATs to sidestep estate and gift taxes, his returns and court records suggest.

In 2008, the year before he sold much of his coal empire to the Russian company, two GRATs appeared on his returns for the first time. And when the Russian company sued Justice, it also sued him in his capacity as the trustee for those GRATs. Justice had placed at least some of the coal assets into the trusts before the sale, according to the lawsuit.

Ruby’s statement did not address Justice’s use of GRATs.

Originally published on ProPublica by Ellis Simani, Robert Faturechi and Ken Ward Jr. and republished under a Creative Commons License (CC BY-NC-ND 3.0)

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.Series: The Secret IRS Files Inside the Tax Records of the .001%

Related Articles:

- ‘Most Significant Charges Yet’: Trump Indicted for Trying to Overturn 2020 Election

- Leader of Oath Keepers Convicted in January 6th Case

- Citing Orwell, Judge Blocks ‘Positively Dystopian’ Censorship Law Backed by DeSantis

- Trumps Likely Campaign Strategy Revealed During Announcement

- Trump is Running in ’24

Find books on Politics and many other topics at our sister site: Cherrybooks on Bookshop.org

Enjoy Lynxotic at Apple News on your iPhone, iPad or Mac.

Lynxotic may receive a small commission based on any purchases made by following links from this page